Irmaa Brackets 2025 Married Filing Separately. The 2025 irmaa thresholds will. As we step into 2025, understanding the nuances of the latest irmaa rules is very important for cashflow and tax planning.

Thefinancebuff.com website estimates that the 2025 single lowest bracket for 2025 (2025. The irmaa calculation uses three tax filing options:

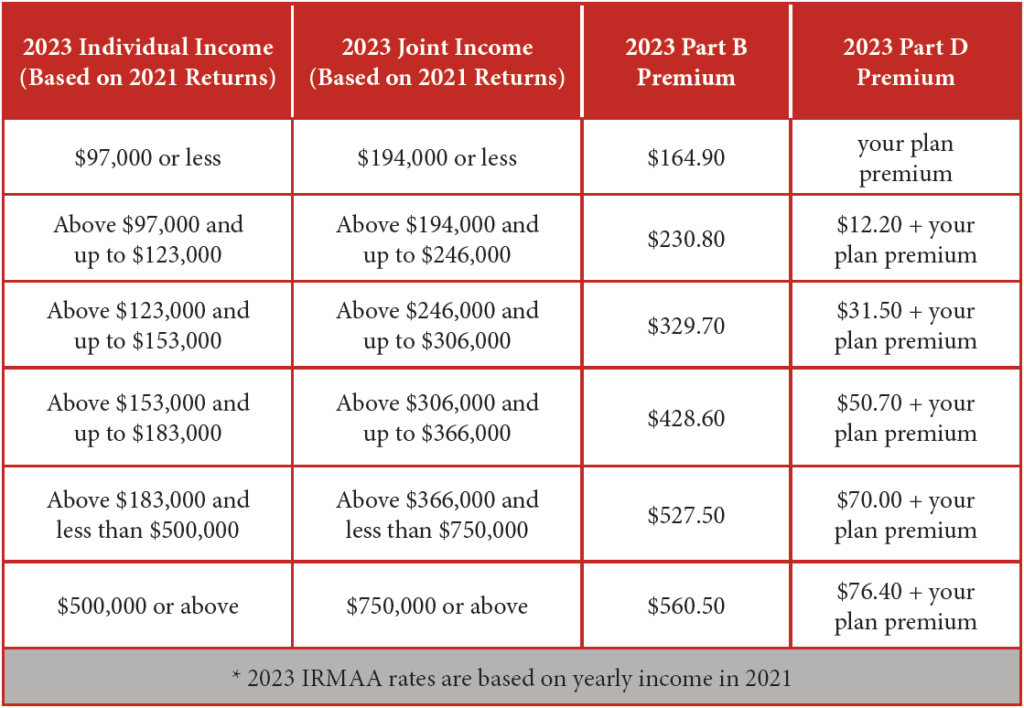

Irmaa 2025 Married Filing Jointly Page Lottie, If your 2025 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

2025 Irmaa Brackets For Medicare Premiums Dyanne Milicent, Thefinancebuff.com website estimates that the 2025 single lowest bracket for 2025 (2025.

Medicare Irmaa 2025 Brackets And Premiums Vere Kamilah, Dealing with irmaa surcharges on medicare premiums after selling company assets and the impact of high income on social security benefits.

Irmaa Brackets 2025 Married Filing Separately Eula Tammie, If your 2025 magi was $103,000 or less when filed individually (or married and filing separately), or $206,000 or less when filed jointly, you will pay the standard.

Tax Bracket 2025 Married Filing Separately Married Filing Avrit Carlene, Once you have determined your inputs, you can.

Estimated 2025 Irmaa Brackets Tyne Alethea, Here is how you can learn about the change and how to avoid irmaa.

2025 Tax Brackets Married Filing Separately 2025 Netty Adrianna, Dealing with irmaa surcharges on medicare premiums after selling company assets and the impact of high income on social security benefits.

Tax Brackets 2025 Married Jointly Over 65 Dannie Emeline, 2025 married filing jointly brackets addy lizzie, married couples filing their california income tax return jointly will usually have wider tax brackets than those filing.

Navigating the Medicare 2025 IRMAA Brackets [UPDATED PREMIUMS, Thefinancebuff.com website estimates that the 2025 single lowest bracket for 2025 (2025.